Card Spend Approvals

Product: B2B small business banking platform, fintech

Outcome: Unlocking employee card adoption and subscription upgrades through pre-spend approval workflows

Context

Relay already offered strong spend controls (limits, merchant and category restrictions), but customer research revealed a critical gap: controls after the fact weren’t enough.

Business owners wanted the ability to approve spend before money left the account, especially for:

Larger purchases

New or less-trusted employees

Cash-flow-sensitive businesses

Surveys showed ~20% of both debit-active and debit-inactive users explicitly wanted spend approval workflows — and multiple customers stated this was the main blocker to issuing cards at all.

The Problem

How might we enable pre-spend approval for employee cards — increasing trust and adoption — without slowing teams down or adding excessive operational overhead?

Goals

Customer

Give business owners confidence and visibility before spend occurs

Prevent surprise or unauthorized transactions

Business

Drive upgrades to paid tiers

Increase employee card issuance and card spend

Strengthen Relay’s differentiation in SMB spend management

Approach & Key Insights

Our core insight was that small business owners value visibility before money leaves the account far more than enterprise customers. When cash flow is tight, every dollar matters — and reviewing transactions after the fact or chasing contractors for explanations isn’t sufficient.

This led us to prioritize a pre-spend approval workflow that gives owners control without slowing teams down. The goal was to enable fast, lightweight approvals at the moment they matter, rather than relying on retroactive controls.

Notably, none of our direct competitors offered this capability. Their spend systems were designed for enterprise finance teams reviewing spend after it occurs, creating an opportunity for Relay to differentiate by building controls purpose-built for small businesses.

Solution

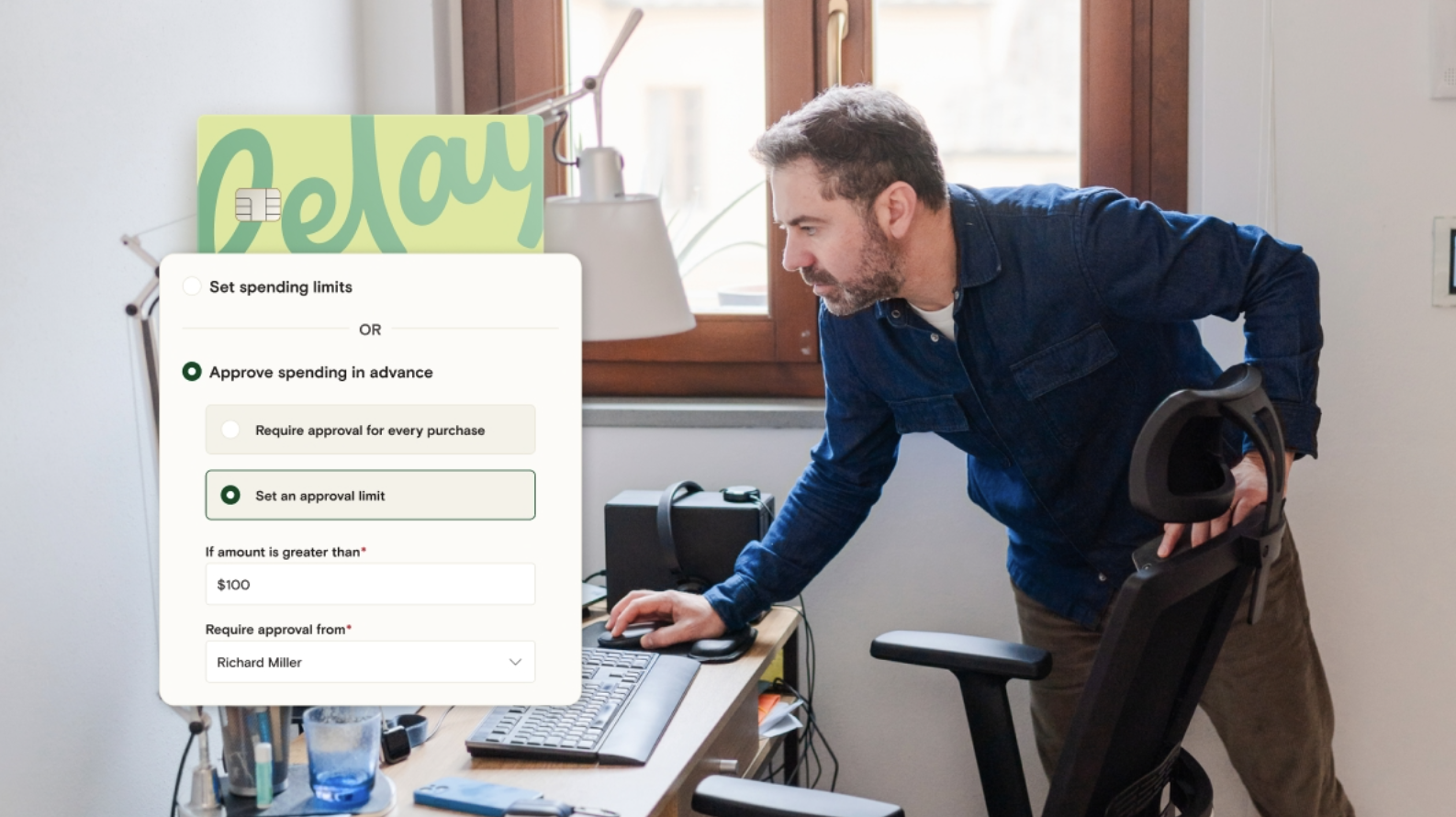

Admins create and manage approval rules

Cardholders submit approval requests with amount, reason, and expiration

Approvers receive SMS/email and act from a centralized dashboard

Approved spend temporarily raises available spend for the defined window

Results

Spend approvals became the top driver of plan upgrades, after lower fees and higher APY (~10% of all upgrades)

Helped increase employee card issuance by ~180%