Credit Platform

Building a critical wallet platform leveraged by teams across the organization and B2B clients.

Context

I owned Hopper’s cash back rewards program, referred to as Carrot Cash Back (CCB), whose primary KPIs were:

Unique conversion

Purchase frequency rate (i.e., number of bookings per user)

Contribution profit / ROI

When I joined Hopper, cash back had been built in the form of offers, leveraging an already existing platform, for the sake of experimentation speed. This meant that cash back earned from individual bookings didn’t accumulate and could not be split. If a user had $10 cash back from a hotel and $5 cash back from a flight, they could only redeem one of these amounts at a time. Each earned cash back amount had a separate expiration date.

Customer research indicated that a majority of users preferred to accumulate their credit card rewards in order to spend them on bigger purchases. For example, about 40% of surveyed users indicated they would wait to accumulate $100 before redeeming their rewards.

Most major OTAs, airlines, hotels, and credit cards allow users to accumulate points and then redeem them towards bookings as they see fit. This is an industry standard and what users expect. Questions around the accumulation and redemption of CCB were frequently fielded by Customer Service agents, an indicator that the existing approach was not optimal for users.

Goals

I thought through the full functionality this new platform needed to have, across the platform and user experience, and prioritized the implementation of the features based on my gauge of business impact, customer value, and effort.

Phase 1: baseline functionality

Accumulation (credit/debit-based system), redemption, splitting, and rolling expiration period - the basic features of a point system had to be in place.

Automatic redemption of the full amount - to start, users would not be able to choose how much of their Carrot Cash to redeem, but they could only redeem the full amount (best impact on the prices they were seeing).

Migration of existing credits - we would migrate existing cash back to the new platform to allow existing users to take advantage of the improved earning and redemption mechanic.

No automatic refunding - to enable speed to market, I worked with an engineer to create a partially manual process that would leverage SQL runs (by me) and a script (by the engineer) to refund users who cancelled bookings once a week. Refunding could be automated later on.

Phase 2: automatic refunding & transaction history

Automatic refunding - once the new platform was working and we had more time, we would replace the manual process with a fully automated one.

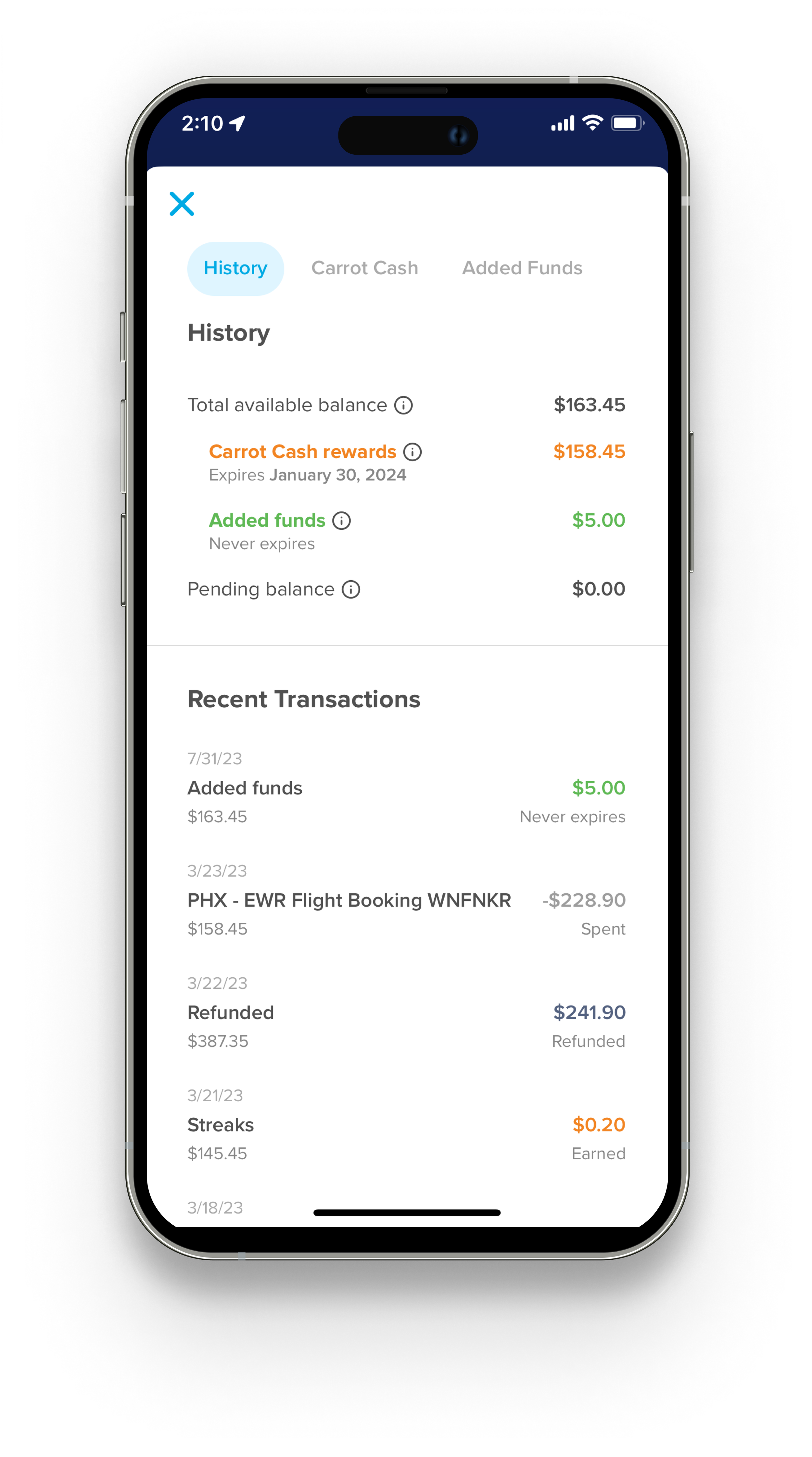

Transaction history - for Phase 1, it was sufficient to show how much Carrot Cash users had available. Eventually, we had to give them transparency around how we arrived at that number (i.e., their Carrot Cash earned and used over time).

Phase 3: credits as a payment method

Credits as a payment method - all of Hopper’s incentives were implemented as automatic price slashes to show the lowest price to the user. By this logic, prices were automatically slashed by the full amount of users’ available Carrot Cash. We wanted to experiment with positioning credits as a payment method, where users could choose how much to redeem, which was a more intuitive approach typical for OTAs. This could wait until later on.

I collaborated with my data scientist to design a credit/debit-based database that would capture all important data elements to allow us to track and monitor Carrot Cash issuance (e.g., program ID, credit ID, amount, expiration etc.).

I worked with finance to determine the appropriate accounting method (FIFO, LIFO, etc.).

I worked with backend engineers to define a transition plan from the old offer platform to the new credit platform. I set up dashboards and ran analysis to ensure the migration had happened successfully and there wasn’t missing or extra Carrot Cash.

For additional precaution, I launched accumulating credits as an experiment, with a subset of the population exposed to it to start. This would allow me to monitor whether any unforeseen technical issues were harming the user experience. Once it was clear the new platform was working, I ramped up the experiment to 100%.

Finally, I collaborated with my designer to develop designs for a new transaction history that would be added to the wallet.

My goal was to build a new platform that would allow us to convert individual CCB offers generated from separate bookings into accumulable credits in order to provide a better user experience and to achieve parity with competitors.

Approach

Results

I spearheaded the development of a critical wallet service that was used by teams across the organization to experiment with various incentive programs (referrals, streaks, credit loading, and others). The platform was also leveraged by Hopper’s B2B team that was building a travel rewards platform for a major U.S. bank.